Holtec grows from spent fuel specialist into major decommissioning player

After a flurry of license transfer agreements with Entergy and Exelon, a new joint venture by Holtec and SNC-Lavalin plans to combine spent fuel storage innovations with economies of scale to drive down decommissioning costs.

Related Articles

The creation of Comprehensive Decommissioning International (CDI), a new joint venture between Holtec and Canada's SNC-Lavalin, has heightened competition in the decommissioning sector.

CDI aims to become the "leading decommissioning contractor" in the U.S. nuclear industry, Pierre Oneid, Holtec’s Senior Vice-President and Chief Nuclear Officer, said in July.

By early August, Holtec had signed agreements to purchase upon closure Entergy's 688 MW Pilgrim plant in Massachusetts, its 811 MW Palisades plant in Michigan, and Exelon’s 636 MW Oyster Creek plant in New Jersey. In addition, Holtec would take control of Entergy's decommissioned Big Rock Point Nuclear Power Plant site which still hosts an Independent Spent Fuel Storage Installation (ISFSI).

The license transfer agreements are expected to be completed in the second half of 2019 and will quickly impact site activities. The Oyster Creek plant is to be permanently shut down this month, while Pilgrim is set to close by June 2019 and Palisades is scheduled to shut down in the spring of 2022.

CDI will combine Holtec's spent fuel storage and transport expertise with SNC-Lavalin's plant engineering, construction and maintenance experience. Holtec is also aiming to build the U.S.'s first consolidated interim storage facility (CISF) for spent fuel and the two companies recently partnered on Holtec's SMR 160 reactor development project.

CDI plans to combine Holtec and SNC-Lavalin’s project management expertise with economies of scale, to accelerate decommissioning times and minimize project costs, Jeremy Parriott, Vice President, Communications at CDI, told Nuclear Energy Insider.

The company aims to release plant sites for unrestricted use within eight years, discounting temporary dry storage installation.

CDI will share lessons in quality and performance in real time across multiple sites and strategic contracts will be put in place to achieve economies of scale, Parriott said.

Multiple site contracts should generate cost reduction opportunities while lowering in-house procurement costs, he said.

New models

Low wholesale prices have accelerated reactor closure plans and Holtec predicts the U.S. decommissioning market could be valued at around $14 billion in 2018-2028.

Nuclear companies are joining forces and introducing new business models to gain a share of the growing decommissioning market.

Last year, Orano (formerly Areva) and U.S. demolition specialists Northstar created a joint company, Accelerated Decommissioning Partners (ADP), to provide a "one-stop" final decommissioning solution for the original operator, introducing technological, regulatory and financial efficiencies.

The latest technologies and optimized strategies could see the dismantling and decontamination (D&D) of U.S. nuclear plants completed within five years of shutdown, Sam Shakir, Chief Executive Officer of Areva Nuclear Materials (ANM), told Nuclear Energy Insider in September 2017.

"It's definitely doable because we are shrinking the spent fuel movement duration dramatically," Shakir said.

ADP and CDI both plan to use dry storage canisters to transfer spent fuel to storage at an earlier stage.

CDI will use Holtec canisters and the dry storage approach should reduce time taken for fuel transfer to less than three years, according to the company.

Shorter defuelling processes significantly reduce costs. Running costs for a shutdown nuclear plant with fuel still in the cooling pool are typically between $25 million and $30 million per year, driven by labor requirements.

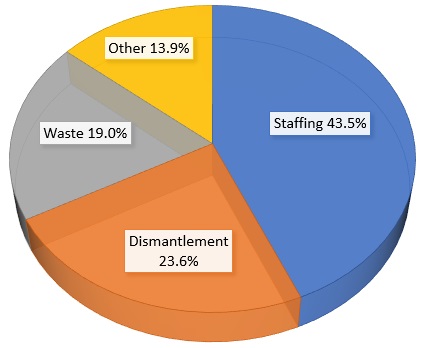

Nuclear decommissioning costs by category (indicative)

Data source: Electric Power Research Institute's 'Decommissioning Experiences and Lessons Learned' report. (2011).

During defuelling, CDI will be able to segment and remove reactor internals, saving further project time. Simultaneous dismantling work is becoming commonplace as companies continue to invent new cutting and packaging technologies to improve safety and efficiency.

CDI will also be able to learn from Holtec’s decommissioning activity at the Vermont Yankee plant. Holtec recently completed defuelling of the Vermont Yankee spent fuel pool within 3.5 years of shutdown.

Storage hub

Holtec plans to use its proposed consolidated interim storage facility (CISF) in New Mexico to store spent nuclear fuel from U.S. nuclear plants, including Oyster Creek.

In March, Holtec announced the U.S. Nuclear Regulatory Commission has accepted Holtec's license application to build a facility that would initially house 8,680 MT of spent fuel and could be expanded to 120,000 MT.

"The NRC provided a preliminary schedule that envisages the issuance of license by July 2020; however, the date will be sooner if Holtec’s responses to the regulatory queries are timely and of high quality," the company said in a statement.

Holtec plans to “eventually” store the spent nuclear fuel at its planned CISF but it is too early to reveal the cost savings of this approach, Parriot said.

Orano USA and Waste Control Specialists (WCS) have also submitted a license application to the NRC for a new CISF in Andrews County, Texas. The proposed facility would initially host 5,000 metric tons (MT) of spent fuel and could be expanded to host 40,000 MT.

Staff plans

If the plant license transfers are approved by regulatory authorities, CDI expects to initiate decommissioning of Oyster Creek plant in 2019, followed by decommissioning of Pilgrim in 2020. A timeline for Palisades will be developed closer to the reactor’s shutdown in the spring of 2022.

Proactive licence regulation actions and human resource planning are key to minimizing front-end decommissioning costs.

Facing widespread closures, Entergy has used experience at its Vermont Yankee site to inform its staff planning and communication strategies. Vermont Yankee staff numbers were cut from 650 during operations to around 315 in the first quarter of 2015 and then reduced to 150 by the second quarter of 2016, according to a presentation by Entergy and Northstar, published in December 2016.

Entergy was able to transfer 95% of plant staff into a new career at another operational Entergy plant or to a Vermont Yankee decommissioning role, Joseph Lynch, Senior Government Affairs Manager Decommissioning at Entergy, said in June 2017.

As a growing company, Holtec will explore employment opportunities for Entergy employees “dislocated” by the decommissioning program at Pilgrim and Palisades, Kris Singh, Holtec President and CEO, said in a statement.

At Oyster Creek, CDI will offer employment to Oyster Creek decommissioning employees, effective upon the transaction closing.

“Holtec’s commitment to the nuclear industry and its presence in New Jersey will allow many of our employees previously facing relocation to continue living and working in the Garden State," Bryan Hanson, Exelon Generation’s chief nuclear officer, said.

By Neil Ford