French presidential favorite pins reactor closures to renewables growth

The election of Emmanuel Macron as French President would see nuclear decommissioning activity surge in the next decade but shutdown dates will depend on measures to accelerate wind and solar development.

Related Articles

The French presidential elections reach a climax on May 7 when centrist candidate Emmanuel Macron faces far right candidate Marine Le Pen in the final round of voting. Macron is the favorite to win the election-- polling at around 59% of the vote on May 1-- and the election result will have a profound impact on the future of EDF’s French nuclear fleet.

While a surprise Le Pen victory would likely see a reversal of France's reactor closure plans, a Macron win would usher in a surge in decommissioning activity in the coming decade. Macron has set out bullish renewable energy objectives and pledged to retain laws introduced in 2015 which aim to cut the share of nuclear power from 75% to 50% by 2025.

However, Macron has not set out a firm position on this nuclear target and market analysts have highlighted the challenge of shutting down an estimated 25 GW of nuclear power capacity over such a short timeframe while maintaining grid stability.

"The lack of a firm position on this issue may be because Mr Macron is well aware that the 2025 target is highly ambitious," Jefferies analysts Ahmed Farman and Oliver Salvesen said in a research note April 24.

The 50% target may instead be reached between 2030 and 2033, a Macron adviser told Bloomberg in a report published April 26. The 50% objective could be reached sooner if ASN, the French nuclear safety authority, imposes tough conditions to extend reactor lifespans from 40 to 50 years, the adviser told Bloomberg.

Some 34 of EDF's 58 reactors will soon reach 40 years of operations and the ASN will publish its safety report on the proposed lifespan extensions in around 2018.

Macron has said he would decide on the future of these plants following the ASN's report.

Green bond

Macron's pledge to reduce the share of nuclear power to 50% is based on a rapid expansion of wind and solar power. Macron has pledged to double wind and solar capacity and close all of France's coal-fired power stations by the end of his five-year term in 2022.

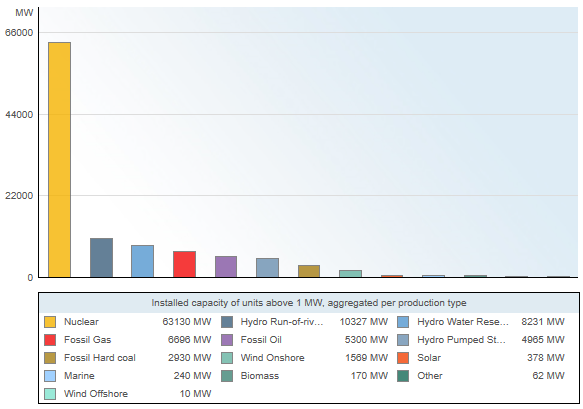

France's installed power capacity by source

Source: RTE (France's national grid operator), 2017.

Macron’s renewables pledge will require an acceleration in the approval process for renewable energy projects. France's wind and solar development has been hampered by regulatory and administrative hurdles and Macron has pledged to simplify the authorization process.

Jefferies analysts Farman and Salvesen estimate the closure of 25 GW of nuclear power capacity in the coming eight years would require around 75 GW of new renewable energy capacity.

"That looks quite challenging given that in the last 10 years only 18 GW of wind and solar was installed in France," the analysts said in their note.

A key advantage for developers going forward is the falling cost of wind and solar power. Technology improvements and improved installation practices have driven wind and solar costs towards wholesale market prices, removing the need for state subsidies in some countries.

Shutdown begins

Macron also supports the current government's pledge to close two 900 MW reactors at Fessenheim when EDF brings online its 1.65 MW EPR at Flamanville, currently expected by the end of 2018. The EPR project is several years behind schedule but on March 15 EDF said it had begun system performance testing in line with its latest construction timetable announced in September 2015.

"The next milestone will involve fuel loading and then start-up at the end of the fourth quarter of 2018," the company said.

The closure of Fessenheim will test EDF’s ambitious cost estimates for plant decommissioning. EDF has estimated decommissioning costs at 350 million euros ($255.7 million) per reactor. In February, a French parliamentary report said these estimates appear too low and noted that other European operators which are further along in the decommissioning process estimated costs at between 900 million and 1.3 billion euros per reactor.

"The cost of dismantling is also under-estimated if we factor in certain elements...the return of the site [to its original condition], removal of spent fuel, taxes and insurance, social costs,..." the report said.

EDF believes learnings from the ongoing dismantling of its Chooz A reactor and the transfer of operational plant data will accelerate future decommissioning projects. Chooz A is the first Pressurized Water Reactor (PWR) to be dismantled in France and all the reactors currently in operation use PWR technology.

Five-year target

EDF aims to complete the decommissioning of the second-generation Fessenheim reactors in "around five years," Frederic Magloire, Chief Technical Officer of EDF’s Chooz A project, said at Nuclear Energy Insider's Nuclear Decommissioning Conference Europe in May 2016.

EDF is using the latest data from operational reactors and dismantling projects to standardize processes and the operator has been able to prepare for the immediate decommissioning of Fessenheim, Magloire said. Unlike the older Chooz A decommissioning project, staff currently employed at the Fessenheim plant will be able to transfer operational expertise directly into the closure phase, he said.

"They know the power plant, it's very important to have the knowledge of the power plant... Many things are written [down] but you have lots of things which are not written," he said.

EDF also has the advantage of being engineer-architect for its nuclear plants, allowing it to access expertise from the design, construction, operation and decommissioning phase of the reactors.

The operator is conducting a fleet-wide standardization project which will provide annual updates of decommissioning cost estimates and benchmarks, to highlight opportunities for multiple-site synergies, Magloire said.

Nuclear Energy Insider