US utilities join forces with SMR vendors to speed development

Vendors and utilities have formed a new SMR industry group to unlock financial and regulatory resources and accelerate deployment in US and abroad.

Related Articles

Leading US Light Water Reactor (LWR) developers and potential utility customers have formed a consortium to jointly tackle the policy, regulatory and costing challenges facing SMR projects ahead of commercial plant build, Nuclear Energy Institute announced January 27.

SMR vendors NuScale, BWX Technologies and Holtec and utilities Duke Energy, Energy Northwest, PSEG Nuclear, Southern Company, SCANA and Tennessee Valley Authority have already signed up to the group.

At least two other utilities have indicated they will join and other vendors and equipment suppliers are expected to join, Dan Lipman, vice president of Nuclear Energy Institute said on a conference call.

"The decision was made that we really need an organisation that represents both buyers and sellers of the technology to speak with a more unified voice on matters of generic industry interest with an eye for deploying SMRs," Lipman said.

As well as tackling matters on US policy, regulation and funding, the START group will look to capitalize on potential applications abroad. US vendors have indicated significant market opportunities in UK and Canada, for example.

Michael McGough, Chief Commercial Officer of NuScale, said the START group would allow "strength in numbers" as projects work through key phases such as design license reviews.

US SMR pre-application license activities to date

Source: Nuclear Regulatory Commission

Utility choices

SMRs are defined as reactors which are below 300 MW in capacity and can be built in modular fashion, gaining from economies of series and requiring lower overnight capital costs than larger conventional nuclear plants.

Due to these lower capital requirements, potential customers include industrial companies and smaller municipal utilities, as well as larger utilities, Lipman told the conference call.

"Utility generation portfolio decisions are being developed, particularly in the wake of the Clean Power Plan [CPP]," he noted.

The opportunities for SMR developers come amid challenging economic conditions for US power generators, as they adjust to rapidly rising renewable energy capacity and low gas prices which have dented the profits of operational nuclear units.

The U.S. Energy Information Administration (EIA) has said new nuclear capacity represents a technology that could reduce CO2 emissions towards US CPP objectives.

In its May 2015 report, ‘Analysis of the Impacts of the Clean Power Plan,’ EIA said that if nuclear is provided credit for zero CO2 emissions the “primary result is that the new nuclear displaces some of the renewable capacity additions as a means of compliance.”

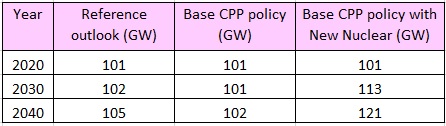

EIA's nuclear projections under Clean Power Plan

Data source: U.S. Energy Information Administration's 'Analysis of the Impacts of the Clean Power Plan' (May 2015)

SMR deployment would not be limited to existing nuclear sites. A key argument by SMR developers is that the smaller reactor cores and other innovative safety features of the SMR designs mean they require smaller Emergency Planning Zones (EPZs) than the 10-mile radius zones required for the US’ operational LWR fleet. The smaller EPZs would allow SMRs to be sited on existing power generation sites closer to densely populated areas, such as former coal power stations, and the Nuclear Regulatory Commission (NRC) has agreed to develop design-specific guidelines for SMRs.

Licensing costs

The START program would look to work with regulators and policymakers to improve the licensing resources available to the new technologies. The design license phase is a critical and costly step towards commercial deployment and the resources of the NRC will need to be appropriately shared between operational reactors and new technology designs.

The first full test of SMR licensing procedures in North America is to come later this year, when NuScale is expected to submit its design license application to the NRC. NuScale has projected it will take three and a half years to receive Design Certification approval after it has submitted the application and the company has spent a number of years in preparatory dialogue with the NRC.

NuScale benefits from having Fluor, a large engineering and construction group, as its majority stakeholder. In 2014, the project won $217 million of U.S. Department of Energy’s funding, towards the design certification application and other commercialization engineering, analysis and testing.

McGough said the project had spent $380 million to date and had called on around half of the DoE funding thus far.

"It will be a billion dollars before we complete the certification of the design and we are ready to build the first commercial project," he said.

Gaining support

Proponents of advanced nuclear technologies have urged for further funding and regulatory support in a series of government bills. Late last year the federal government increased funding for SMR licensing and signalled strengthening support for advanced reactors.

The fiscal 2016 Omnibus Appropriations Act raised annual funding for SMR Licensing from $55 million to $63 million and increased funding for reactor Research and Development (R&D) from $133 million to $141 million.

The new funding boost came just a month after the federal government announced its new Gateway for Accelerated Innovation in Nuclear (GAIN) program, designed to “provide the nuclear energy community with access to the technical, regulatory, and financial support necessary to move new or advanced nuclear reactor designs toward commercialization.”

Under the GAIN Plan, announced at a White House Summit on Nuclear Energy, the government is to increase its $12.5 billion loan guarantee program for innovative nuclear energy projects- including SMRs. The guarantees will also apply to licensing costs, such as design certification, construction permits and combined construction and operating licenses.