Westinghouse adapts reactor saws as Germany deal tests scaling gains

A six-reactor segmentation contract in Germany has doubled Westinghouse's ongoing reactor dismantling portfolio in Europe and the group is manufacturing new mechanical cutting tools to help boost parallel project efficiency, Joseph Boucau, Director, Global D&D and Waste Management Business Development, told Nuclear Energy Insider.

Related Articles

Westinghouse's new contract to dismantle the reactor pressure vessel (RPV) internals of six PreussenElektra reactors in Germany will test the U.S. group's latest decommissioning learnings and its ability to optimize resources. Westinghouse is part of the Zerkon consortium-- led by Germany's GNS-- which won the contract to dismantle and package the reactor internals in January.

Westinghouse has segmentation contracts in place at 13 power reactors in Europe and is currently performing dismantling activities at four different sites.

Benefits of large decommissioning portfolios include lower equipment and training costs and more efficient labor deployment. Key challenges include staff and equipment availability, differences between local licensing certification and project management with a wide range of partners.

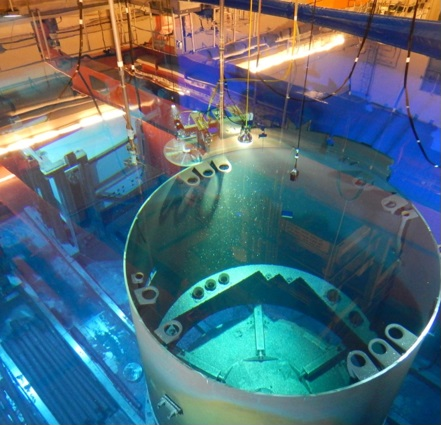

Segmentation of reactor internals is one of the most complex decommissioning tasks and preparation is key. Operators look to minimize the duration of fuel transfer and reactor dismantling due to the high labor costs associated with monitoring and handling radioactive materials.

The first PreussenElektra plant to be dismantled is the 1.4 GW nuclear Unterweser nuclear power plant (KKU) in the state of Lower Saxony, north-west Germany.

PreussenElektra was awarded the license to decommission the KKU pressurised water reactor (PWR) plant in February and the segmentation project is now in the "engineering and tooling design phase," Boucau told Nuclear Energy Insider.

The Zerkon partners will apply learnings from the KKU project to optimize tooling and decommissioning techniques at the other five reactors when they come off-line in the coming years. Westinghouse will dismantle up to two plants in parallel, to maximize efficiency while conforming with schedule requirements of the operator.

“The activities of the whole program are planned in a staggered manner so that optimum program efficiency can be gained,” Boucau said.

Westinghouse's current segmentation contracts in Europe

Source: Nuclear Energy Insider. Data source: Westinghouse

Decommissioning companies are now applying the latest automation and visualization technologies to improve planning and gain greater accuracy in dismantling work.

Westinghouse and GNS, a waste packaging specialist, are using the latest 3-D modelling software to optimize the dismantling and packaging of the KKU reactor internals.

This allows Westinghouse to build up an inventory of tools to optimize its European decommissioning portfolio.

“We are capitalizing sufficient equipment to cope with the overall needs of the PreussenElektra fleet contract as well as with our other on-going segmentation projects,” Boucau said.

Westinghouse is designing and manufacturing new cutting equipment such as hydraulic shears, bandsaw and disc saws. The group has worked with a wide range of cutting technology and favors mechanical cutting processes for overall project optimization and safety.

Westinghouse's tools minimize dose levels for personnel, maximize visibility in the pool water, and allow simpler collection of debris, Boucau said.

“Using a reliable and safe segmentation technique reduces the risk of schedule slippage,” he noted.

Cutting techniques could evolve in the coming years. A recent study by the U.S. Electric Power Research Institute (EPRI) found that deployment of thermal arc saw cutting, underwater lasers and self-operating systems could shorten reactor segmentation projects and cut costs.

Unique challenges

European decommissioning activity is on the rise as ageing fleets and energy policy shifts combine with stubbornly-low wholesale power prices. By 2020, some 150 European reactors will have reached a 40-year lifespan.

Decommissioning companies continue to build a body of learnings. While over 160 reactors have been shut down for decommissioning globally, only around 20 have completed dismantling activities.

A key challenge for decommissioning partners is that no two plants have exactly the same site conditions, reactor design and project requirements.

"There is always something new to bring, or to modify," Boucau said.

Recent projects conducted by Westinghouse illustrate how reactor size and topography impact decommissioning strategies.

The segmentation of reactor internals at Spain's 150 MW Jose Cabrera (Zorita) PWR plant resulted in 432 cut pieces for a total weight of 59.5 tonnes (T). Removal of the reactor vessel from the pit and segmentation resulted in 140 cut pieces for a total weight of hundred 14 T.

In comparison, the segmentation and packaging of Sweden's 615 MW Barseback 2 boiling water reactor (BWR) resulted in 2,176 cut pieces with around 150 T of cut internals.

In August 2017, Westinghouse began segmentation work at EDF's 310 MW Chooz A reactor in France, under a turnkey contract for the dismantling of reactor vessel and internals and cutting of operational waste. Chooz A is the first PWR reactor to be decommissioned in France-- there are currently 58 PWRs in operation.

A unique feature of the Chooz A plant is that it is located in two caves excavated in a hillside, rather than in a conventional containment design. This meant a range of preparatory works had to be performed at the site before dismantling activities could begin.

"For instance the cave entrance had to be enlarged to bring in our larger equipment," Boucau said.

A hot cell was also built at Chooz A to fulfil waste responsibilities set out in the contract.

At the 840 MW Neckarwestheim 1 PWR plant in Germany, Westinghouse had to segment the upper internals while the spent fuel was still in the containment.

"This is not common, usually you remove the spent fuel, then you do the work in the vessel," Boucau said. Westinghouse was responsible for segmentation of reactor internals as part of a consortium including Uniper and GNS.

"We also had to bring two new working bridges to be more efficient on site," Boucau added.

Westinghouse will also bring new working bridges to the PreussenElektra projects, to reduce dependence on the plant polar crane and reduce the risk of delays.

“These working bridges have been designed to allow their reuse with minimum modifications from plant to plant,” Boucau said.

Estimated private company spending for Germany's nuclear clean-up

(Click image to enlarge)

Source: German Federal Ministry for the environment (BMU), 2015.

Vertical gains

European decommissioning projects are typically broken into work packages of varying size that are subject to public tenders.

Another way to improve decommissioning efficiency is the vertical "bundling" of work packages into larger scope such as containment systems dismantling.

"This leads to good synergies, in terms of cost reduction and shorter planning," Boucau said.

One example is at the two 440 MW Bohunice V1 VVER units in Slovakia, where Westinghouse is leading the dismantling of the reactor coolant systems under a contract awarded in September 2017.

The scope of this contract includes the dismantling and waste management of around 9,500 T of material, including the full primary circuits, reactor internals reactor vessels, auxiliary equipment, plant systems and dry storage for high-activated operational wastes.

"Implementing such a project in multiple separate packages would have led to a much longer schedule," Boucau said.

In the U.S., vertical bundling has gone a step further as dismantling and waste experts combine to provide full scope decommissioning and waste services.

In February 2017, French-owned nuclear group Areva and U.S. demolition specialists Northstar created a new joint decommissioning company which plans to acquire the complete and permanent ownership of decommissioning assets, including used nuclear fuel.

The new joint company, Accelerated Decommissioning Partners (ADP), is designed to provide a "one-stop" final decommissioning solution for the plant operator and introduce technological, regulatory and financial efficiencies to lower project durations and costs.

Europe could soon see similar "turnkey" decommissioning contracts as operators look to shorten project durations and optimize costs, Jorg Klasen, Director of Decommissioning at EnBW, said in May 2017.

"We don't have these kinds of suppliers in Europe yet- not in Germany- but I propose that we will have these kinds of suppliers also in the future," he said.

Nuclear Energy Insider